About Us

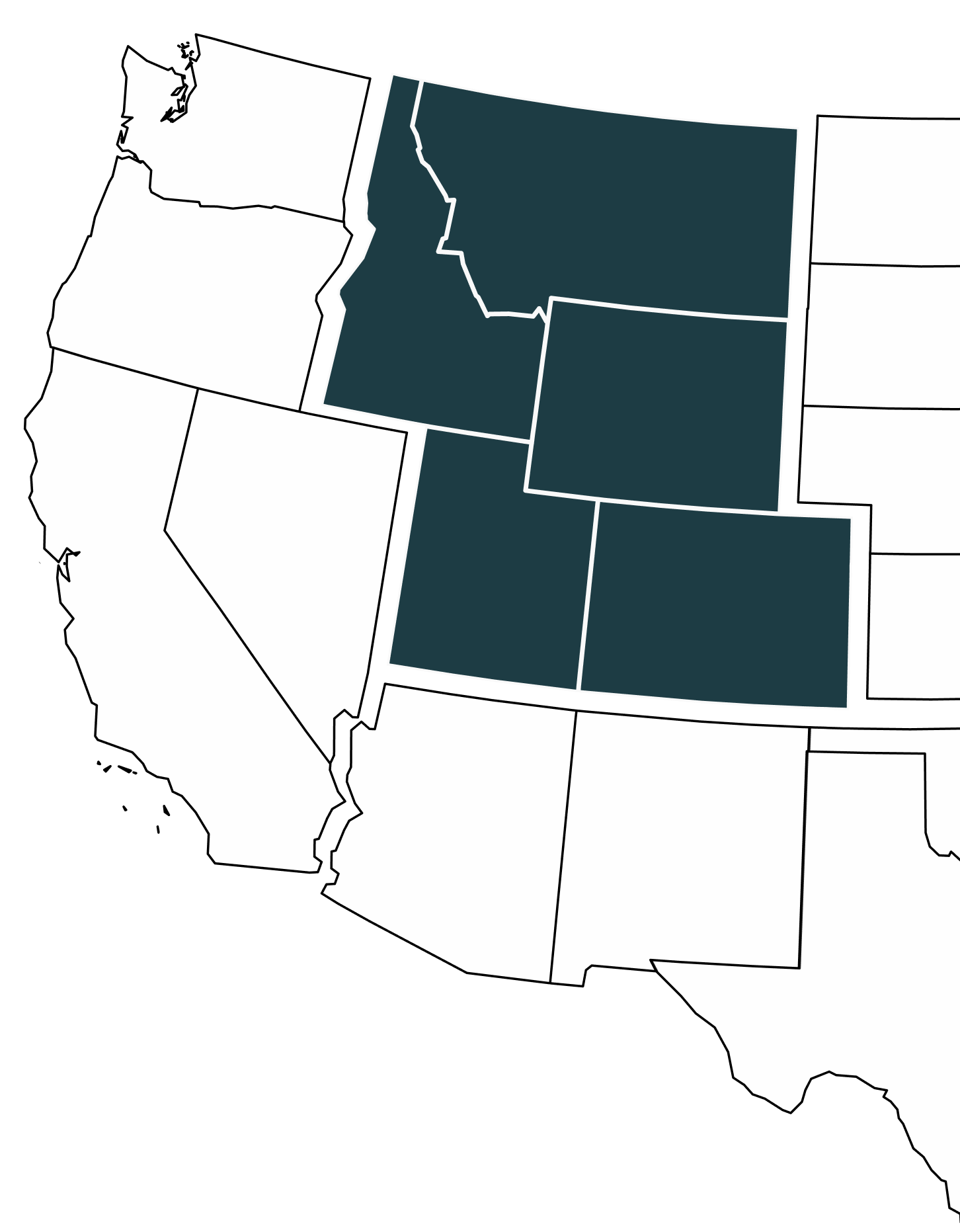

Kreation Capital is a real estate investment and development firm primarily focused on opportunities across the Mountain West region, including Idaho, Montana, Wyoming, Colorado, and Utah. With more than 25 years of combined experience, the principals of Kreation Capital specialize in ground-up development, creative capital structuring, and complex project execution in markets characterized by high barriers to entry.

Kreation Capital is a relationship-driven platform that approaches each market and project with a long-term mindset. The firm focuses on building enduring partnerships with local stakeholders, municipalities, landowners, and capital partners, integrating its projects into the local fabric rather than pursuing one-off developments. This approach enables Kreation Capital to execute responsibly, navigate complexity effectively, and create assets that are both economically durable and locally supported.

The firm intentionally targets regions with strong demographic tailwinds and “timeless” demand drivers, including proximity to national parks, ski mountains, rivers, and other natural amenities that are inherently scarce and unlikely to lose relevance over time. Investment strategies are underpinned by disciplined underwriting, conservative assumptions, and an emphasis on downside protection, while preserving meaningful upside through development and operational execution to support repeat investment and scalable long-term growth.

Kreation Capital is a relationship-driven platform that approaches each market and project with a long-term mindset. The firm focuses on building enduring partnerships with local stakeholders, municipalities, landowners, and capital partners, integrating its projects into the local fabric rather than pursuing one-off developments. This approach enables Kreation Capital to execute responsibly, navigate complexity effectively, and create assets that are both economically durable and locally supported.

Kreation Capital intentionally targets regions with strong demographic tailwinds and “timeless” demand drivers, including proximity to national parks, ski mountains, rivers, and other natural amenities that are inherently scarce and unlikely to lose relevance over time. Investment strategies are underpinned by disciplined underwriting, conservative assumptions, and an emphasis on downside protection, while preserving meaningful upside through development and operational execution to support repeat investment and scalable long-term growth.

Why The

Mountain West?

-

Idaho, Utah, and Colorado rank among the fastest-growing states since 2010, driven primarily by net in-migration. Utah (+18.4%), Idaho (+17.3%) and Colorado (+14.8%) have grown well above the U.S. average.

-

Mountain West states continue to post positive net migration through 2025, indicating durable post-pandemic trends. In 2025, Idaho recorded the highest inbound migration rate (~71%) of any U.S. state, outpacing many Sun Belt destinations.

-

Inbound households skew toward ages 25-54 with above-average incomes. Many Mountain West markets saw typical homebuyer incomes grow ~24% above pre-pandemic levels, reflecting an influx of higher-earning professionals.

-

The region consistently outperforms national employment growth, supported by tech, healthcare, and manufacturing. Utah added ~31,900 jobs in 2025, leading regional job gains, while Idaho had the fastest state job growth rate (~2.9%) among all U.S. states.

-

Hybrid and remote work continue to funnel professionals from high cost metropolitan areas.

-

Housing costs remain materially below major coastal markets, even despite recent appreciation.

-

Outdoor recreation is a core driver for migration. States with abundant nature access are repeatedly ranked among the most desirable relocation and lifestyle destinations.

-

Low taxes and pro-growth policies attract both employers and residents.

-

Modern travelers increasingly prioritize authentic, immersive experiences over material goods. 72-75% of millennials prefer spending on experiences, a shift that has accelerated post-COVID and is reshaping travel, housing, and real estate.

-

Instead of passive vacations, travelers seek hands-on, personalized activities tied to nature, wellness, and local culture. In the U.S., 181 million people (~60% of the population) participate in outdoor recreation annually, underscoring broad, mainstream demand for active, experience-driven travel.

-

COVID accelerated demand for health-oriented, outdoor, and lower-density experiences. Since 2019, participation in key outdoor activities has surged: surfing (+25%), skiing (+90%+), and hiking/camping, reflecting a durable shift toward experiential travel.

-

Platforms like Instagram and TikTok amplify demand for unique, share-worthy experiences. Experience-led travel now drives location choice, with global surf and ski-adjacent destinations continuing to expand.

-

Experiential travel is directly reshaping real estate. Travelers increasingly favor immersive stays, supporting a $1+ trillion global experiential/adventure travel market, with ~60% of demand tied to nature-based activities.

-

Experiential travelers are moving beyond gateway cities into rural, scenic, and emerging markets. This has fueled investments into mountain, coastal, and wilderness regions as the global adventure tourism market grows from ~$350B (2024) to ~$740B by 2028 (~20% CAGR).

-

Experience-driven travel delivers outsized local impact. Outdoor recreation alone generates ~$1.2 trillion annually in U.S. economic output and supports ~5 million jobs, reinforcing long-term demand for experiential real estate and place-based development.